Add costs and interest to what's owed

If you had to spend money trying to collect what the judge said the other side owes you, you can ask to have those costs added to what you're already owed. Interest is added to the judgment automatically, but if you want it to appear on a writ of execution, you need to document it for the court.

Before you start

Document your costs

You'll need to file a written statement saying what you've spent and how much interest needs to be paid. The court does not keep track of this. You will want to keep records so you can keep track and use in case the other side questions any costs you claim.

You only can add costs from the past 2 years

You have 2 years from the time you pay a collection cost to add it to what's owed. Not all collection costs will be added. Some costs are easy to add, and you can use the form Memorandum of Costs After Judgment, Acknowledgment of Credit, and Declaration of Accrued Interest. For costs not described on this form, you have to make a formal noticed motion. Sometimes, the court will allow you to add attorney's fees.

You can report interest at any time while the judgment is active

Interest runs on the judgment automatically. But, you will want to have it added if you are getting a writ of execution. The rates are different depending on what led to the judgment.

Generally, any unpaid principal balance collects interest at 10%, or 7% if the debtor is a government agency. This general rule applies to any judgment against a business or government agency, or where the money is owed due to a tort or fraud, or judgments for unpaid wages or other money due to an employee.

Broadly, a tort is when someone does something, usually dangerous or careless, and it causes someone to get hurt or damages something they own. For example, if someone runs a red light and causes a car accident. Common examples are assault, battery, trespassing, or negligence.

A tort is not when someone breaks a contract. For example, when someone signs an agreement with a credit card company, but then does not make a payment they agreed to make. That is called a "breach of contract". It is not a tort.

If the judgment is for medical expenses, the rate of interest decreases to 5% if the amount owed is less than $200,000. If the judgment is for personal debt, the rate of interest decreases to 5% if the amount owed is less than $50,000.

Limits on interest rates for some judgments related to medical expenses or personal debts

For any judgment entered or renewed on or after January 1, 2023, the interest rate on any unpaid balance is 5% if:

- The side that owes the money (the judgment debtor) is a person, not a business or government agency,

- The principal balance owed is less than $200,000 and related to a medical expense or is less than $50,000 and related to a personal debt, and

- The money owed is not due to a tort, fraud, unpaid wages, or other money owed to an employee

How to add costs and interest

-

Calculate costs and interest

Get together proof of your costs

Add up receipts or other records from fees paid to the court clerk or other places you had to spend money to collect (like the sheriff, county clerk, or process server). You can only add costs from the past 2 years.

Calculating interest owed

Calculating interest can be tricky, especially if the other side has made some payments because you calculate interest only on the amount that hasn't been paid.

- The San Diego Superior Court’s free online program will calculate the amount due on a specific day. All you do is input the judgment amount, date, and payment history, and the program does all the calculations for you. The calculator sets the interest at 10%.

- If you want to calculate by hand instead, read the Information Sheet for Calculating Interest and Amount Owed on a Judgment (form MC-013-INFO).

-

Fill out form

Fill out and put in what you added up in the last step into:

- Memorandum of Costs After Judgment (form MC-012)

This tells the court what you've spent and what interest needs to be added.

-

Make a copy

Make 1 copy of the Memorandum of Costs to send to the other side.

-

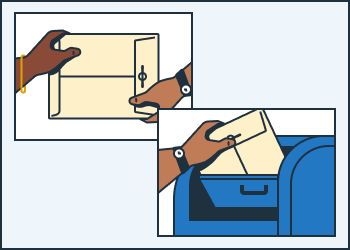

Serve the Memorandum of Costs

Have someone 18 or older, not you or someone else involved in your case, hand-deliver or mail the copy of the Memorandum of Costs After Judgment to whoever owes you money. The person who mails is your server.

Your server must then fill out the proof of service on the second page of the original Memorandum of Costs After Judgment.

-

Make another copy with the Proof of Service filled out

Make 2 copies of the Memorandum of Costs After Judgment with the signed proof of service on the second page.

-

File the Memorandum of Costs

- File the original and 2 copies of your Memorandum of Costs After Judgment.

- The court will process the paperwork, and return the 2 copies, stamped, to you.

- The court will keep the original papers for its file.

-

Wait for response

If the person who owes you money doesn’t file anything with the court saying they disagree, your Memorandum of Costs After Judgment is automatically approved.

If the other side files a Motion to Tax Costs, you will be served with a copy of the motion. If you disagree, you must file and serve your response at least 9 court days before the court date about the costs. A judge will decide if the costs and interest can be added.

Civil judgment collection

What's next?

After you have your costs and interest added, you can keep trying to collect what's owed. If the other side ends up paying you, you need to let the court know.